Although most of us do it on almost a daily basis, driving on the road comes with its fair share of risks and challenges. From distracted drivers to poor weather conditions, numerous factors can contribute to accidents. One specific risk that often goes unnoticed until it’s too late is being hit by an underinsured driver. Keep reading as we shed light on this issue and highlight the potential consequences of such collisions. By understanding the risks involved, we can take proactive measures to protect ourselves and ensure we’re adequately covered in the event of an accident.

What Does Underinsured Mean?

Before exploring the risks, let’s first understand what it means for a driver to be underinsured. Simply put, being underinsured refers to a situation where a driver’s insurance coverage is insufficient to fully compensate for the damages caused in an accident. This could be due to low coverage limits or inadequate policy types.

Financial Impact on the Victim

When an underinsured driver causes an accident, the financial burden often falls on the victim. If the damages exceed the at-fault driver’s coverage limits, the victim may be left to cover the remaining expenses out of their own pocket. This may include medical bills, property damage, and even lost wages. Without adequate insurance coverage, the victim may face significant financial strain and struggle to recover from the accident.

Limited Compensation for Medical Expenses

Medical expenses can quickly add up following a car accident. From emergency room visits to ongoing treatments, the costs can be overwhelming. In the case of an underinsured driver, the victim’s ability to obtain proper compensation for medical expenses may be severely limited. This can result in delayed or incomplete treatment, leading to prolonged recovery periods or even permanent injuries.

Impact on Vehicle Repair or Replacement

Aside from medical expenses, damage to the victim’s vehicle is another area where the impact of being hit by an underinsured driver is felt. Depending on the severity of the accident, the victim’s car may require extensive repairs or even be deemed a total loss. If the at-fault driver lacks adequate insurance coverage, the victim may struggle to receive full reimbursement for the cost of repairing or replacing their vehicle. This can leave them without a means of transportation or force them to settle for subpar repairs.

Lost Wages and Income

Being involved in a car accident may result in temporary or permanent disabilities that hinder the victim’s ability to work. This loss of income may further exacerbate the financial strain caused by the accident. When dealing with an underinsured driver, the victim may face difficulties in recovering lost wages and income. The limited coverage provided by the at-fault driver’s insurance company may not be sufficient to compensate for the full extent of the financial losses.

Uninsured or Underinsured Motorist Coverage

To mitigate the risks associated with being hit by an underinsured driver, it’s crucial to have uninsured or underinsured motorist (UM/UIM) coverage as part of your auto insurance policy. UM/UIM coverage provides financial protection in cases where the at-fault driver has insufficient or no insurance. This coverage helps bridge the gap between the damages incurred and the compensation received, ensuring that the victim is adequately protected.

Reviewing Your Auto Insurance Policy

In light of the potential risks of being hit by an underinsured driver, it’s essential to review your auto insurance policy on a regular basis. Make sure that you have sufficient coverage limits, including coverage designed to protect you against uninsured or underinsured drivers, to protect yourself in the event of being involved in an accident. Understanding the terms and conditions of your policy can help you make more informed decisions when choosing or modifying your coverage.

Consulting with an Insurance Professional

Navigating the complexities of auto insurance can be overwhelming. It is worth considering consulting with an insurance professional if you are unsure about the adequacy of your coverage or need assistance when it comes to understanding your policy. These experts can assess your needs, recommend appropriate coverage options, and ensure that you have the necessary protection in case of an accident involving an underinsured driver.

Your Rights and Options

When dealing with the aftermath of an accident caused by an underinsured driver, it’s important to be aware of your rights and the options available to you. At Payam Law, our experienced and knowledgeable attorneys specializing in personal injury or car accident cases are here to provide valuable guidance in navigating the legal landscape. They can help you understand the intricacies of insurance policies, assess the damages, and pursue appropriate legal action if necessary. We’re here to ensure that your rights are protected, and you receive the compensation you deserve for the injuries and losses you have suffered.

In the unfortunate event that you have been involved in an accident with an underinsured driver, it’s essential to seek the support and advice of legal professionals who can guide you through the process of getting the justice and compensation that you deserve. That’s where we come in at Payam Law. With years of experience in personal injury and car accident cases, our dedicated team is well-equipped to handle your claim.

Don’t let the burden of an underinsured driver’s actions weigh you down. We understand the complexities of dealing with underinsured drivers, and the challenges that you may face when it comes to recovering your losses. We work tirelessly on your behalf to negotiate with insurance companies, pursue legal action when necessary, and fight to get you the maximum compensation.

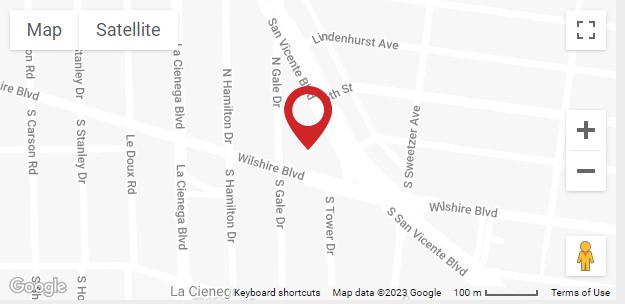

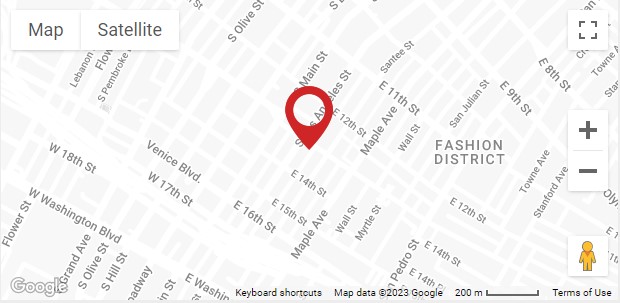

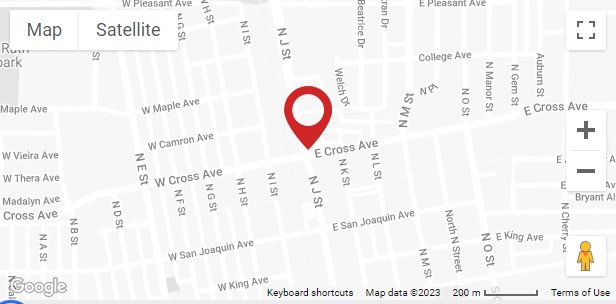

Take the first step towards justice and contact us today. Our compassionate, experience team is ready to advocate for you. Our offices are at:

- Beverly Hills – 8383 Wilshire Blvd, Suite 830, Beverly Hills, CA 90211

- Los Angeles – 212 East Pico Blvd, Suite #4, Los Angeles, CA 90015

- Tulare – 100 E. Cross, Suite #122, Tulare, CA 93274

- Hanford – 13400 Hanford Armona Rd, Suite #B

Call now for a free consultation on (877) 729-2652 or (323) 782-9927.